Tentative Oil Deal Stalls as DNO Holds Out; Baghdad Approves KRG July Salaries

Despite upbeat statements from both KRG and Iraqi officials suggesting an imminent breakthrough on the resumption of Kurdistan’s oil exports, no final agreement has yet been reached. Ali Nizar, director of Iraq’s SOMO, said the talks have reached the “final stages,” but exports will only resume once “all remaining details are finalized.”

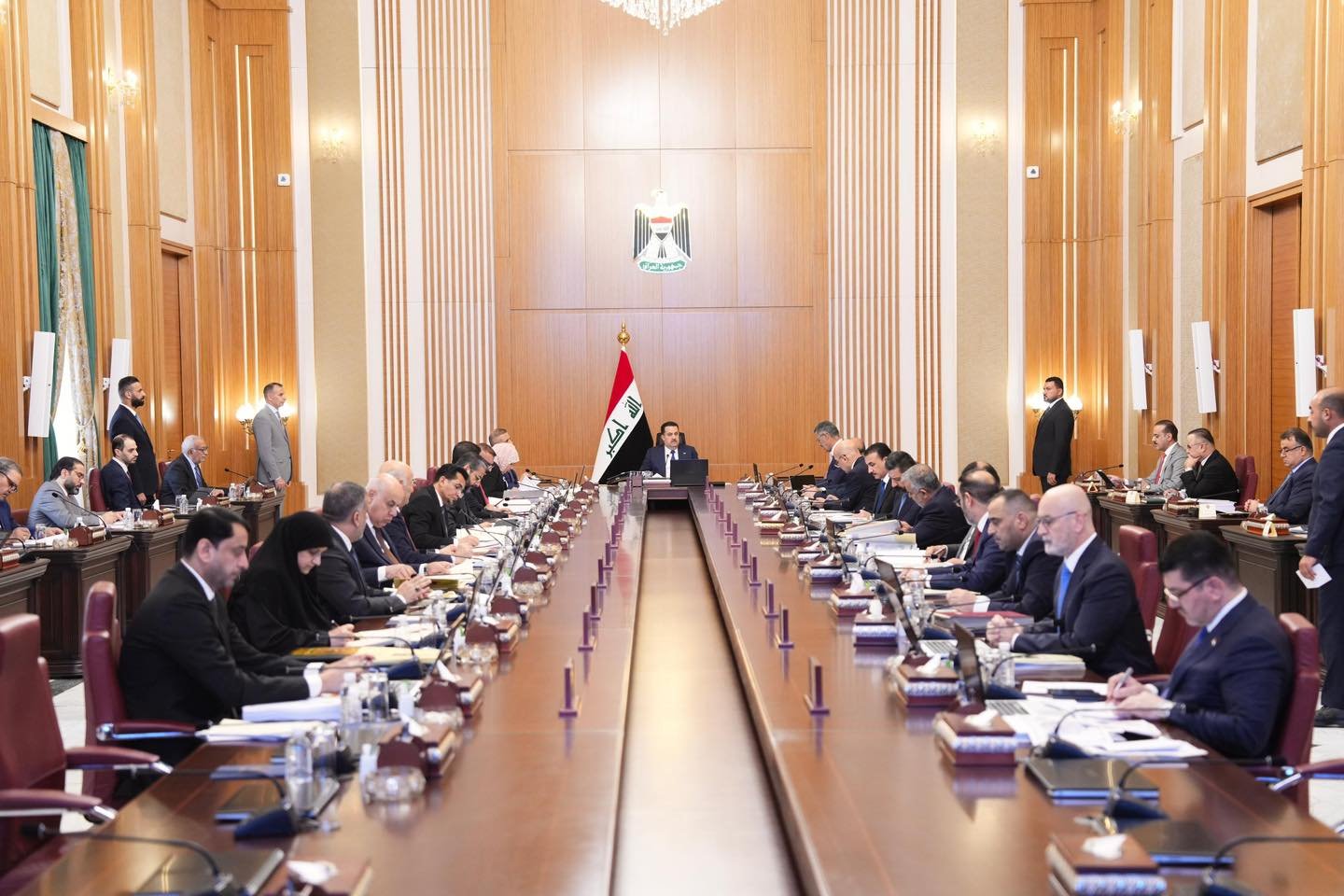

At the same time, the Iraqi Council of Ministers decided today to release July salaries for the Kurdistan Region’s public employees. Officials confirmed that this transfer is tied to the KRG’s obligation to remit 120 billion dinars in non-oil revenues to Baghdad, while leaving the details of the oil agreement to be finalized by the oil ministry.

Context: After months of negotiations—and amid mounting pressure on the KRG due to unpaid salaries—the Iraqi government, the KRG, and international oil companies say they have agreed on a temporary four-page framework to restart Kurdistan’s halted exports. Under the draft, companies are to be compensated in oil to settle the long-disputed $16 per-barrel production cost payment. Between 180,000 and 230,000 barrels are slated for export daily depending on capacity, with another 50,000 reserved for local consumption. Disputes are to be referred to the Paris-based international arbitration court.

Yet the deal remains incomplete. DNO and its partner Genel Energy—together controlling roughly 30% of the Kurdistan Region’s output, or about 65,000 barrels per day—have refused to sign, insisting on repayment guarantees for past debts. The KRG owes DNO an estimated $300 million, while overall arrears to all producers are said to exceed $1.5 billion. DNO’s full capacity is 85–90,000 barrels per day, but output has recently fallen due to drone strikes.

Details: A source from the Northern Oil Company told Rudaw TV that their representative attended the latest meeting, which brought together Iraq’s Oil Ministry, the KRG’s Ministry of Natural Resources, and international oil firms. According to the source, Kurdistan’s crude is to be delivered to the Northern Oil Company’s Zakho station near the Turkish border, then transferred to Ceyhan port. Oil from Kirkuk fields will not be included.

The source added that no firm timeline has been set, though exports could resume within days once the Council of Ministers issues its final approval. Another participant in the negotiations confirmed that exports are expected to restart shortly after the agreement takes effect.

Still, major uncertainty hangs over implementation. According to the Iraqi Center for Energy, the framework is only temporary—lasting two months—and lacks parliamentary cover as Iraq enters its November election season.

However, significant uncertainty remains over the details of the deal. In today’s Iraqi Council of Ministers meeting, it was decided to push ahead with the tentative oil export framework without DNO. But if DNO is excluded, questions arise over the position of its partner, Genel Energy, which owns 25% of the two blocs DNO operates and together currently produce around 80,000 barrels per day.

Conflicting accounts have emerged. One report, citing a source from the meeting, said DNO’s share—currently about 60–65,000 barrels per day—would be diverted for local consumption, with the remainder handed over to SOMO. Yet it is unclear how feasible this would be in practice, since it would require a separate arrangement to purchase DNO’s oil for domestic use. Such a mechanism would again expose DNO to an agreement with Baghdad, something the company has already rejected without guarantees on its arrears.

If DNO were fully excluded and another 50,000 barrels set aside for local consumption as previously agreed, the volume of oil the KRG could deliver to Baghdad for export would fall to just over 100,000 barrels per day—potentially making resumption of pipeline exports unfeasible.

Other sources, however, suggest that today’s meeting only tied the release of July salaries to the KRG transferring 120 billion dinars in non-oil revenues, meaning that many of the technical details of the oil framework remain unresolved.

DNO underscored its position in a statement today: “As the largest producer, the arrears owed to us by the KRG dwarf those of many of the others. Our exposure to future payment risk is also substantially higher than any other company.”

The company operates the Tawke and Peshkabir fields jointly with Genel Energy, which holds a 25% interest in the blocs. In the first half of 2025, average production stood at 78,421 barrels per day—of which Genel’s share was 19,605 bpd and DNO’s share 58,815 bpd. The modest decline in Q2 output was attributed to the 12-day Iran–Israel conflict.